Referencing data from a new study from Renofi, REALTOR® Magazine reports that, “in Nevada, home prices have more than doubled since 2010, surging nearly 106%.” See What Will Homes Be Worth in 10 Years?

In their study, Renofi analyzed the average home price in every state, comparing it from September 2010 to September 2020, and then using that number to project a September 2030 value.

Renofi’s analysis projects Nevada’s September 2030 home value to be $652,526. [Note: Renofi’s Methodology states:

To estimate property prices in 2030, we took the average price in each state and the 50 most populated cities in the US for the present day (September 2020) and ten years ago (September 2010).

We then calculated the rate of change in values between the two dates and applied this rate of change to the average price in September 2020 to estimate how they might look in 2030, assuming that they continue on that same trajectory.

It’s unclear if by “average price” Renofi is referring to list prices or sold prices.]

Reno, NV home prices in 2030

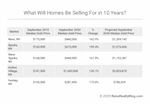

Just for fun I decided to apply a similar methodology to home prices in our local markets. For my analysis, I looked at median sales price changes from September 2010 to September 2020 in the following markets and then used that delta to project the median sales price for 2030.

The table below shows the results of this exercise…

Hmmm…Reno, Nevada median home price at $1.2M in 2030. What do you think? I would love to hear your thoughts in the comments below.

Note: Residential median home price data includes Site/Stick Built properties only. Data excludes Condo/Townhouse, Manufactured/Modular and Shared Ownership properties. Data courtesy of the Northern Nevada Regional MLS and the Incline Village REALTORS® – October 27, 2020. Note: This information is deemed reliable, but not guaranteed.

For historical home sale data dating back to 1998 click here.

Click here to see Reno Homes for Sale.

Click here to see Incline Village Homes for Sale.

Catherine

I sure hope inflation doesn’t pick up that way with a starter home in Reno costing a million dollars!

Chuck

Sounds high. I’ll take the under on that bet.

At a $1.15 million median price by 2030, home prices in Reno/Sparks would have to grow by 10% each year for the next ten years. That’s far higher than 3%-5% average annual price growth the market has experienced over an extended time. Also, 10% annual price growth would far exceed the pace of growth in the area’s median household income. Who would be able to buy at such high prices? Also, the article does not predict uptick in inflation, which has been around 2% per year for a couple of decades. So, if incomes and inflation are growing at less than 3% per year, what would be the driver for 10% annual price appreciation — an influx of buyers from California? I guess we’ll have to wait and see.

Using historical price growth rates of 3% – 5%, and no excessive uptick in inflation, I would expect 2020’s $440,000 median price in Reno/Sparks to grow to a figure between $590,000 and $715,000 by 2030.

Guy Johnson

Thank you for your comments, Catherine and Chuck. And thank you for reading the blog. Much appreciated! Good points made, Chuck.

regularguy

I predict that Reno prices will be lower in 2030 than they are today – A LOT lower. This is the biggest housing bubble in history, and Reno is the most overpriced market in the entire nation. The idea that they would go over a million is one of the most preposterous things I’ve ever heard. Housing is shelter which is paid for by wages, not speculative gains.

Guy Johnson

Thank you for your comment, regularguy.

Reid Weber

I like they way you do math. Its not very realistic though as in 2010, we were at the lows after a housing crisis. But as long as we are dreaming, we could use your math a bit longer. It would be worth $8,357,161 in 2050 or $21,970,977 in 2060. If my grandchildren sell it in 2100, it will be more than $1 Billion.

Guy Johnson

Thank you for your comment, Reid.

Carl

Prices are already too high for many of us. Rents are impossible for many of us. The number of homeless is higher than it’s ever been, and it’s in part as a result of profit taking by real estate vultures.

Tangii

Seeing that my Mom sold a townhome in the bay area in 2000 for 350k and now 22 years later it’s worth 1.2 million your number aren’t completely outrageous. Especially if we continue tech company growth here and we don’t have the same amount of land as they do in the bay.

Cali ruined reno

I have been living her my whole life nothing has change much in options of things to do but the prices continue to go up as wages go up maybe this city has become a california city problem is the locals dont have out of state money people like you want it to become more expensive when its the same city it was 15 years ago with 400000 californians here now nobody is going to pay a million for a house that is worth 300000 max anywhere else this place is worthless and all people like yourself want out of state owners to just purchase a home with cash and not even actually live in it you are pathetic.

edmund mcgrath

The discussion can begin and end with the construct of Californians. Any city that has been infested with Californians is by definition going to suck. Whether the Phoenix Las Vegas Boise Reno. It’s more than the California money it’s the California attitude and passive aggressive and sense of entitlement that they bring with them wherever they go. And by the way since I’m typing this out real estate agents are literally at the bottom of the barrel in terms of morals and ethics. There also not very bright as you can tell by this bloggers idiotic mathematical equation. Most people don’t realize that you don’t even have to have a fifth grade education to get a real estate license. There are no educational requirements. None. A one week class on the Internet and you are a licensed real estate agent. The questions on the real estate exam are as easy as passing the drivers test at the DMV. I mention this only because anything written or spoken by a real estate agent has to be taken with a very stern dose of a grain of salt. They know absolutely zero nothing and any opinion they have to be immediately discarded by anyone particularly that has a postgraduate education. Don’t mention the case shall index to any of them they would know what you’re talking about. I went to yell and I know Robert Schiller but I’m not a real estate agent and if you want to know anything about real estate trends speak to a PhD in economics not some schmo named Joe that sells real estate in Reno.